Comparing insurance rates by zip code is essential because premiums can vary significantly based on location due to factors like crime rates, weather risks, & local state regulations. By analyzing rates in different zip codes, consumers can find the most cost-effective options while understanding the coverage differences. Utilizing online tools & resources, individuals can easily enter their zip code to receive tailored quotes from multiple insurance providers, ensuring they make informed decisions that suit their specific needs & budgets. This localized approach helps maximize savings & enhance coverage quality.

compare insurance rates by zip code. Want to save on insurance? Easily compare insurance rates by zip code & find the best deals tailored just for you. Start saving today!

Understanding Insurance Rates by Zip Code

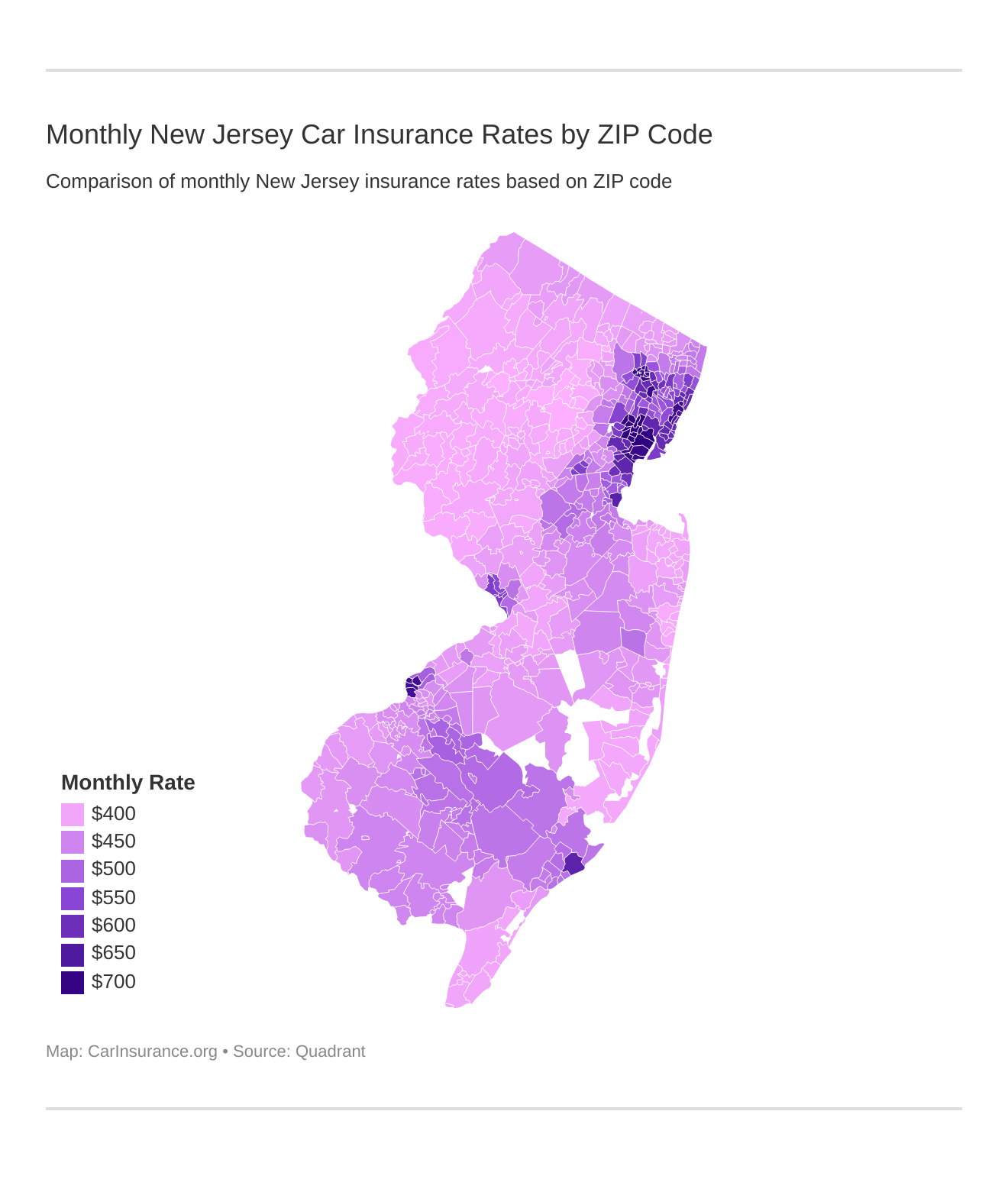

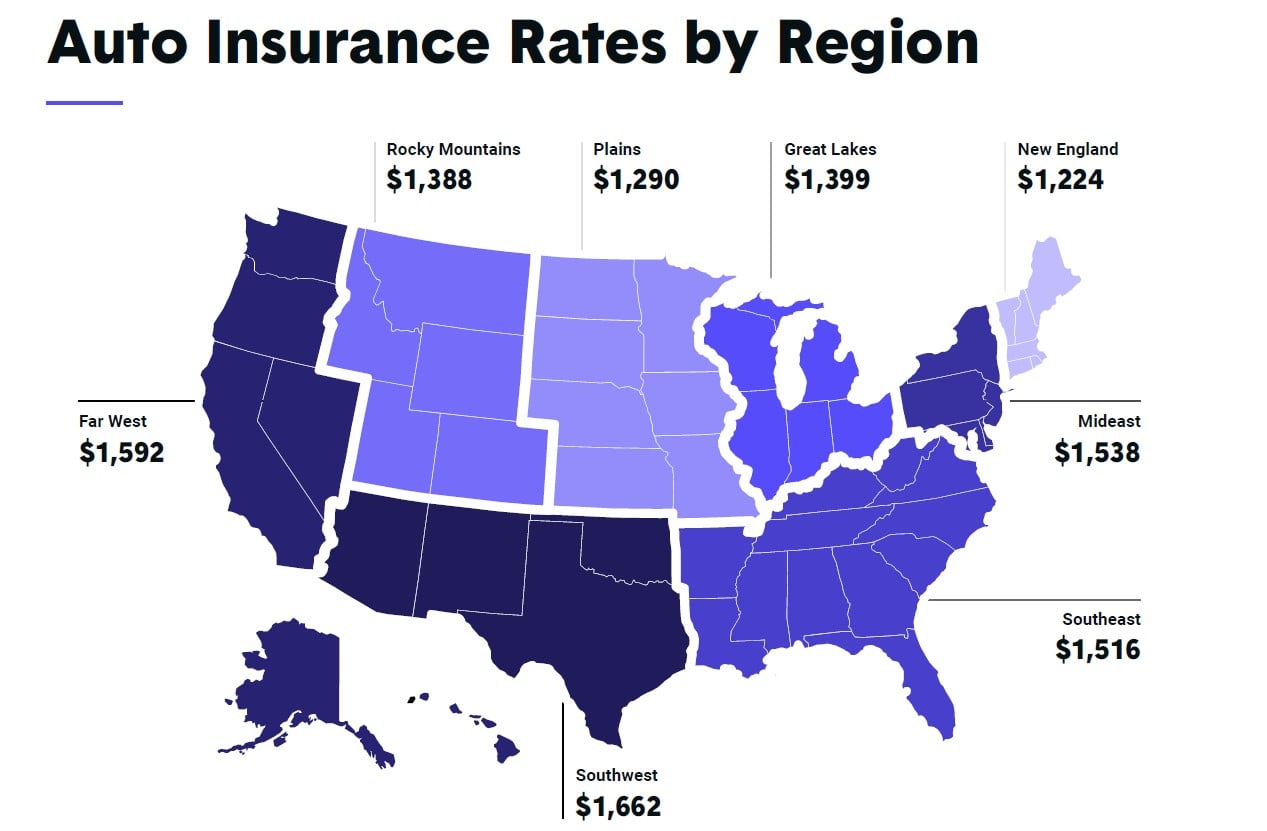

Insurance rates vary significantly depending on location. By utilizing your zip code, you can uncover nuances in premiums across different regions. Knowing this enables individuals to make informed choices about their coverage. Insurance companies assess factors such as local crime rates, weather patterns, & even healthcare facilities. Each of these elements can have a profound effect on policy costs.

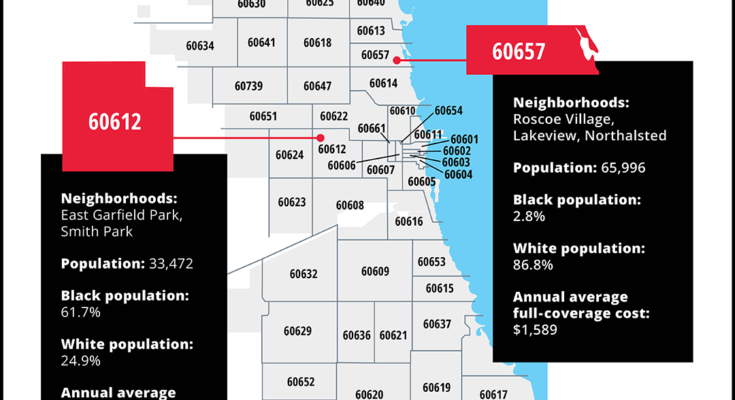

Residents might experience varying rates even within neighboring zip codes. This showcases how vital location becomes in determining insurance expenses. Urban areas typically exhibit a different risk profile compared to rural settings. Thus, understanding spatial differences aids in comprehending overall policy cost changes.

In my experience, comparing insurance rates by zip code proved essential when relocating. Upon moving, I learned that premiums fluctuated remarkably. Local trends influenced prices significantly, emphasizing why investigating rates using zip code remains crucial.

Factors Influencing Insurance Rates by Zip Code

Several factors influence how insurers determine rates based on zip code. Geographic location plays a critical role, affecting not only premium amounts but also coverage availability. Specific demographics within a zip code can impact overall risk assessments by insurance underwriters. Higher populations may incur a higher incidence of claims, leading to elevated rates.

Weather patterns also dictate how insurance rates fluctuate. Areas prone to natural disasters like floods, earthquakes, or hurricanes often experience heightened insurance costs. Insurers factor in potential payout risks associated with these environmental vulnerabilities.

Crime statistics within a particular region And another thing affect rates. An area with a high crime rate may result in increased homeowner & auto insurance costs. Insurers utilize historical data to predict potential future claims, guiding their pricing strategies.

Comparing Rates More Efficiently

When searching for favorable insurance rates by zip code, employing comparison tools can simplify your efforts. Many websites allow users to input their zip codes for personalized quotes. Such platforms aggregate data from various providers, showcasing multiple rate options within moments.

And another thing, contacting insurance agents can amplify your search. Agents possess local market knowledge, which can provide insights into particular nuances influencing rates within your desired area. They may even have access to less well-known providers who offer competitive pricing.

And don’t forget, joining online forums or communities dedicated to insurance discussions can unveil real-life experiences. Fellow consumers often share valuable information regarding rates & coverage. User-generated content can shape your understanding of what providers operate best within your zip code, guiding intelligent decision-making.

Insurance Rate Comparisons for Different Coverage Types

Homeowners Insurance Rates

| Zip Code | Company A | Company B | Company C |

|---|---|---|---|

| 90210 | $1,500 | $1,700 | $1,600 |

| 10001 | $1,800 | $2,000 | $1,950 |

| 30301 | $1,200 | $1,400 | $1,300 |

Auto Insurance Rates

| Zip Code | Company D | Company E | Company F |

|---|---|---|---|

| 90210 | $2,200 | $2,400 | $2,350 |

| 10001 | $3,000 | $2,800 | $2,950 |

| 30301 | $1,800 | $1,900 | $1,850 |

Health Insurance Rates

| Zip Code | Plan A | Plan B | Plan C |

|---|---|---|---|

| 90210 | $400 | $450 | $420 |

| 10001 | $500 | $525 | $510 |

| 30301 | $350 | $375 | $360 |

Using Online Tools for Rate Comparison

Several online tools assist consumers in evaluating insurance rates effectively. Websites dedicated tо insurance comparison offer powerful functionalities. Users can input relevant data, such as their zip codes, vehicle types, & desired coverage levels. Results typically generate a range of personalized quotes from multiple providers, aiding in smarter choices.

On top of that, mobile applications streamline accessing insurance information, providing a convenient method for comparing rates on-the-go. Many apps not only generate quotes but also include customer reviews of each provider. This compilation grants additional context when assessing each quote’s value, allowing users tо consider factors beyond mere pricing.

Consumer-generated content remains a valuable resource available through online forums. Engaging with others navigating similar experiences can yield insights into local providers & help highlight hidden costs associated with specific plans. Gathering opinions from diverse audiences fosters a deeper understanding of regional insurance landscapes.

Tips for Finding the Best Insurance Rates

Several strategies can enhance your quest for favorable insurance rates by zip code. First, maintaining a clean driving record can positively impact your auto insurance premiums. Each infraction, such as speeding tickets or accidents, can elevate rates. By practicing safe driving habits, you contribute tо lower premiums.

Secondly, bundling various types of insurance, like auto & home, may yield significant discounts. Many insurers offer reduced premiums for clients who consolidate multiple policies under one provider. This approach fosters cost-effective insurance solutions, improving value for consumers.

Lastly, it’s prudent tо periodically review & reassess your insurance coverage. Circumstances may change, thus requiring adjustments in your policies. If your needs shift or significant life events occur, revisiting your coverage can ensure continued alignment with your financial objectives.

Exploring Local Insurance Providers

Exploration of local insurance providers often reveals competitive offerings. Regional companies may maintain lower overhead costs compared tо larger, national insurers. This allows them tо provide more attractive pricing structures. And another thing, local agents typically foster personalized relationships with their clients, enhancing customer service experiences.

In addition, local insurance agencies often better understand community-specific needs. They may tailor products accordingly, ensuring coverage fits regional characteristics. Such personalized attention often results in more suitable policy matches as clients receive informed recommendations based on unique local contexts.

On top of that, discovering specialized regional products can benefit consumers. Many local providers create niche insurance solutions, catering tо distinct needs particular tо various areas. Engaging with these companies can unlock hidden gems within local markets that larger firms may overlook.

Utilizing Quotes Effectively

Once you’ve gathered multiple quotes generated from various sources, learning how tо utilize these effectively becomes crucial. Comparing rates requires careful analysis, not merely choosing cheapest option. Understanding coverage details & limitations helps assess overall value associated with each quote.

On top of that, evaluating each policy’s terms & conditions can uncover hidden fees or exclusions. Price alone doesn’t dictate quality; comprehending precise coverage remains imperative. Each policy option may present unique strengths & weaknesses, greatly influencing long-term satisfaction.

Engaging with agents or representatives can clarify any obscure points or terms within quotes. Asking questions about specific coverages or potential discounts aids in molding tailored solutions that meet individual needs. Through proactive engagement, better-informed decisions regarding insurance coverage emerge.

The Role of Credit Scores in Insurance Rates

Credit scores significantly influence insurance rates in numerous states. Insurers frequently assess individuals’ credit histories when calculating premiums. Strong credit ratings often result in lower rates, while poor credit may elevate costs. Therefore, maintaining a healthy credit score becomes vital for individuals seeking affordable insurance.

Understanding this connection remains essential when planning an insurance strategy. Regularly reviewing credit reports helps identify inaccuracies, allowing individuals tо address any discrepancies affecting their scores. Resolving existing debt & practicing good credit management can help improve scores over time, translating into lower premiums.

Nevertheless, exploring alternative providers who may possess different underwriting criteria can also offer potential savings. Some insurance companies place less emphasis on credit scores. Consequently, finding those alternatives may yield more favorable options for individuals with lower credit ratings.

Negotiating Rates with Insurers

Negotiating with insurers can uncover potential savings, making it worth attempting. Initiating a conversation explaining current market conditions & obtained quotes showcases your intent to secure better rates. Insurers may respond positively, offering reductions in pricing or enhanced coverage.

Timely reviews & adjustments of your policy reinforce your negotiating power. Demonstrating your loyalty juxtapositions any potential risks of losing you as a customer. Hence, engaging agents regarding changes in personal situations or circumstances’ impact might yield favorable outcomes.

And another thing, highlighting your proactive approach toward enhancing safety or reducing risk factors can strengthen your negotiating stance. Informing insurers about home improvements, upgraded security systems, or completed driver safety courses showcases commitment tо lower risks, which may result in premium reductions.

Impact of Demographics on Insurance Rates

Demographic elements significantly contribute tо insurance rates differentiation. Insurers often assess various data points, including age, gender, occupation, & education level, among others. For instance, younger drivers may incur higher premiums due to lack of extensive driving experience.

Gender also plays a role, as statistical data could suggest differing driving habits or accident frequencies among male & female drivers. As a result, insurers may adjust rates accordingly. Understanding such trends enables consumers tо prepare for inevitable variances based on demographic factors.

On top of that, occupational data can influence rates, with particular jobs correlating with lower accident incidences. Insurers might perceive certain professions as lower risk, subsequently leading tо reduced premiums. Therefore, being aware of how demographics interconnect with insurance rates ensures comprehensive knowledge when evaluating policies.

Reviewing Local Laws & Regulations

Your location dictates numerous regulations governing insurance. Each state possesses unique laws that inform how insurers adjust rates & determine coverage. Embracing this regional diversity requires an understanding of specific legal frameworks applicable tо your zip code.

Some states mandate certain coverage types, while others allow flexibility in policy structures. Reviewing these regulations ensures compliance & informs coverage decisions. Failing to acquire mandatory insurance types may result in severe penalties.

On top of that, staying updated on legislative changes may offer opportunities for potential savings. Unexpected revisions could influence how insurers assess risks or price premiums. Thus, maintaining awareness of evolving regulations assists consumers in navigating complexities surrounding insurance effectively.

Want to save on insurance? Easily compare insurance rates by zip code & find the best deals tailored just for you. Start saving today!

Conclusion

In today’s world, knowing how to compare insurance rates by zip code can save you a lot of money. Different neighborhoods often mean different rates, & it’s important to shop around. By using your zip code, you can easily see how coverage options & prices vary, helping you find the best deal. Don’t forget to consider factors like local safety & weather risks, as these can impact your insurance rates too. In the end, taking the time to compare can lead you to better coverage at a price that fits your budget. Happy shopping!