To insure a ring, first obtain a professional appraisal to determine its value. Contact multiple insurance providers to compare policies specifically covering jewelry, ensuring they include loss, theft, & damage protections. Some homeowners or renters insurance policies may cover jewelry, but additional coverage might be necessary for high-value items. Document the ring with photographs & keep receipts. Once you’ve chosen a policy, complete the necessary paperwork & provide any required documentation to finalize the coverage. Regularly review & update the policy as the ring’s value may change over time.

how do you insure a ring. Looking to **insure a ring**? Learn simple steps to protect your precious jewelry & get peace of mind with the right **ring insurance** today!

Understanding Insurance for Your Ring

When considering how one might insure a ring, multiple aspects hold significance. First, recognizing value of your ring becomes imperative. Engagement rings, heirlooms, or luxury jewelry often come with a high emotional & monetary value. Each piece carries unique stories & memories. Insuring a valuable ring guarantees protection against potential loss, theft, or damage. In past experiences, I understood this concept when I accidentally damaged my engagement ring. Thankfully, insurance had been a priority, allowing for a simple replacement process.

Why Insuring A Ring Matters

Significance of securing a ring cannot be overstated. Whether a wedding ring or a special gift, rings often symbolize deep bonds & commitment. A sudden loss or damage could lead not only to financial implications but also emotional distress. Insuring such items helps alleviate these worries. And don’t forget, jewelry can appreciate over time, increasing its value. Insurers tend to recommend periodic appraisals, ensuring that coverage reflects current market prices.

And another thing, many people overlook risks associated with wearing rings daily. Everyday activities can expose jewelry to scratches, chips, or other harm. Having coverage ensures that accidental damage will not come from personal finances. Knowing protection exists allows wearers to enjoy their jewelry without constant fear of damaging it.

On top of that, insurance policies differ significantly. One might find options ranging from homeowners’ coverage, standalone jewelry insurance, or specific policies tailored for valuables. Understanding various options ensures optimal choice suited for individual needs.

Types of Insurance for Rings

When searching for suitable coverage for your valuable piece, various options come into play. Primarily, two types emerge: jewelry insurance & homeowners’ insurance. Each serves distinct purposes & carries different benefits.

Homeowners’ insurance adds a layer of protection for rings among other personal belongings. Be that as it may, this often comes with limitations. Policies may only cover up to a specific amount for jewelry, typically less than actual value. Hence, additional coverage might become necessary.

Conversely, specialized jewelry insurance offers personalized coverage. This type tailors policies specifically for valuable pieces, like rings. Coverage usually includes loss, theft, & accidental damage. Researching both options enables informed decisions based on personal circumstances & preferences.

Assessing Value of Your Ring

Before proceeding with any insurance policy, first assessing your ring’s value becomes essential. Have an appraisal conducted by a certified gemologist or professional jeweler. They can provide accurate evaluations based on materials, craftsmanship, & current market conditions.

During this appraisal, documentation becomes instrumental. Gemologists often provide written reports, detailing characteristics like carat weight, clarity, & color of stones. Such documentation proves invaluable when applying for insurance, facilitating smoother processes.

And don’t forget, documentation from appraisals should remain updated. Jewelry prices fluctuate over time. Regularly reassessing value ensures that coverage reflects current market conditions. Many insurers suggest reevaluating every few years or after significant changes.

Shopping for Ring Insurance

Embarking on a journey of acquiring insurance involves shopping around. Comparison remains crucial. Seek out companies specializing in jewelry insurance. Gather quotes from various providers. Look for customer reviews & ratings. An established company often offers better peace of mind.

Discuss specific needs with potential insurers. Inquire about coverage terms, exclusions, & claims processes. Understanding these components will provide a clearer picture of what protection entails. Ask about deductibles & limits on claims, which can greatly impact overall value perception.

One crucial aspect of shopping for coverage involves assessing customer service quality. Having supportive, responsive representatives available during claims or questions can enhance overall experience. Read testimonials of people who have claimed insurance; their feedback can provide insight into how insurers operate.

Features to Look for in Jewelry Insurance

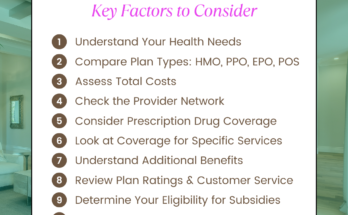

Choosing a provider involves knowing key features that every good policy should offer. Consider these elements when evaluating different providers:

- Comprehensive coverage for various risks including theft, loss, or damage.

- No deductible or low deductible options to minimize out-of-pocket expenses.

- Worldwide coverage, ensuring peace of mind while traveling.

- Replace or repair options, providing flexibility in case of loss.

- Replacement cost vs. actual cash value, understanding how claims amount will be handled.

How to File a Claim

Once you secure insurance, knowing how to file claims becomes fundamental. If loss or damage occurs, acting quickly remains important. Many policies require timely notifications, usually within a specified period after incident. Gather all relevant documentation, including appraisals, purchase receipts, police reports (if applicable), & photographs of items.

Upon initiation of a claim, contact your insurer through chosen method phone, website, or email. Following up on any required information expedites process. Insurers will assess the claim & provide instructions regarding potential next steps, which could involve submitting to inspections or evaluations.

Once all documentation is submitted, insurers will review your claim. Timeframes can vary based on complexity. Be prepared for potential follow-up questions from adjusters. Staying proactive can significantly influence efficiency of claim processing.

What to Do If Your Claim Gets Denied

Occasionally, claims might face denial despite best efforts. Understanding denial reasons can provide pathways for resolution. Common reasons include insufficient evidence, incorrect information, or coverage policy exclusions.

- Request clarifications from insurer regarding specific denial reasons.

- Gather additional evidence or documentation supporting your claim.

- Discuss options with a customer service representative for potential appeals.

- Know your policy thoroughly; identify any miscommunications or misunderstandings.

- Seek assistance from consumer advocate organizations, if needed.

Managing Your Insurance Premiums

Insurance premiums vary widely depending on multiple factors. Managing these aspects can result in lower costs while maintaining necessary coverage. First, consider what factors influence premiums, such as overall value of ring, location, security measures in place, & individual claims history.

One way to control spending involves implementing security measures. Investing in a safe or storage box can deter theft, potentially lowering premiums. Some insurers even offer discounts for security features, such as alarm systems or camera installations.

Another strategy encompasses raising deductibles. While this may seem counterintuitive, opting for higher deductibles could reduce premiums significantly. Just ensure comfort with covering potential costs in case of a claim. Each individual’s financial situation should influence this decision.

Review Your Policy Regularly

Reviewing insurance policies regularly can aid in ensuring continued alignment with personal circumstances. Changes may impact needs, such as marriage, divorce, or relocating. Each of these events could influence overall insurance coverage required.

- Schedule annual reviews with your insurer.

- Adjust coverage as needed based on purchases or losses.

- Stay informed about changes in insurance laws or market practices.

- Reassess deductibles & premiums regularly for cost-saving opportunities.

- Ensure policy reflects latest appraisals & value updates.

The Cost of Insuring Your Ring

Understanding overall cost associated with insuring valuable jewelry requires some consideration. Premiums usually depend on multiple factors, including type of insurance, value of the ring, & chosen deductible. Typically, annual premiums might range from 1% to 3% of jewelry value, though variances exist.

On top of that, factors like security measures in place or past claims might influence rates. Jewelers often recommend multiple quotes from varying providers. Research maintains informed decisions regarding best pricing options.

Making investments in valuable jewelry deserves protection; thus, understanding associated costs, benefits, & evaluating numerous options assists in making sound financial choices.

Important Considerations When Insuring A Ring

Before deciding on coverage for your ring, several key points warrant consideration. Assessing personal circumstances ensures that chosen insurance reflects your unique needs & circumstances accurately. Seek clarity regarding policy details & claims process, as comprehending these aspects minimizes potential confusion.

And don’t forget, communicate openly with insurance representatives. Transparency about what one expects can lead to better coverage options. Understanding risk factors specific to your situation such as potential theft areas or wearing frequency can enhance overall protection.

Finally, cultivate a relationship with your jeweler or appraiser. Having trusted professionals can aid in both valuation assessments & insurance claims. Their support often proves invaluable when navigating potential jewelry concerns.

Different Payment Options for Insurance

Exploring various payment methods for insurance can simplify overall management. Most providers offer flexibility regarding premiums. One can typically choose between monthly, quarterly, or annual payment options. Assess which structure suits your budget; some prefer smaller monthly payments, while others may favor annual lump-sum payments.

Choosing annual payments sometimes provides cost benefits, as many insurers offer discounts for pre-paying the full year. Reviewing these options helps decide what becomes most manageable.

And another thing, inquire about any available discounts. Some companies might offer reduced premiums for bundling insurance policies or for having a longstanding customer relationship. Understanding payment options & potential savings will only enhance financial planning.

Best Practices for Jewelry Insurance

Engaging in a comprehensive approach toward securing coverage offers peace of mind. Consider these essential practices:

- Maintain regular appraisals, keeping documents organized.

- Communicate effectively with your insurance agent.

- Keep inventory of jewelry, including photographs & descriptions.

- Secure documentation & appraisal records in a safe place.

- Review policies periodically, adjusting coverage as needed.

| Cost Factors | Description | Impact on Premium |

|---|---|---|

| Type of Cover | Denotes extent of coverage; comprehensive vs. basic policies. | Higher costs for comprehensive options. |

| Location | Risk evaluation based on geographical area. | Higher premiums if living in high-crime areas. |

| Value of the Ring | Overall worth impacts initial premium calculations. | Higher values result in increased premiums. |

“Taking steps to ensure your ring creates a safety net for cherished memories.”

| Claim Process Steps | Explanation |

|---|---|

| Notify Insurer | Initial notification after damage or loss. |

| Document Evidence | Gather necessary paperwork, photographs. |

| Submit Claim | Follow procedures laid out by the insurance company. |

Conclusion on Insuring a Ring

Insuring a ring represents an integral aspect of protecting valuable possessions. Ensuring understanding of various policies, assessing worth, & maintaining up-to-date documentation contributes significantly towards successful insurance management. Strategic planning paired with knowledge can provide inherent peace of mind, allowing wearers to fully appreciate their beloved jewelry without undue worry.

Looking to **insure a ring**? Learn simple steps to protect your precious jewelry & get peace of mind with the right **ring insurance** today!

Conclusion

Insuring your ring is a smart move for peace of mind. Start by getting a professional appraisal to determine its value. Next, check with your homeowner’s insurance or consider specialized jewelry insurance for better coverage. Don’t forget to review the policy details, so you know what’s included. Keeping your insurance documents in a safe place is important, too. Remember, an insured ring means you can enjoy it without worry. Take these steps to protect your precious piece & ensure you’re covered in case of any loss or damage. Happy insuring!