To choose the right insurance, start by assessing your needs & risks consider factors like health, property, & financial obligations. Research different types of policies & providers, comparing coverage options, exclusions, & limits. Evaluate your budget to determine premiums you can afford, & seek out discounts or bundling options. Read customer reviews & financial ratings to gauge reliability & service quality. Finally, consult an insurance agent for personalized advice, ensuring you select a policy that offers optimal protection while aligning with your financial goals.

how to choose the right insurance. Wondering how to choose the right insurance? Discover simple tips & advice to find the best coverage for your needs without the hassle!

How to Choose The Right Insurance

Understanding Types of Insurance

Familiarity with different insurance types helps identify coverage needed. Major categories include health, auto, home, & life insurance. Each type addresses specific risks, making informed choices crucial for adequate protection.

Health insurance covers medical expenses incurred due to illnesses, providing financial security during unexpected health challenges. Auto insurance protects against damages resulting from accidents or theft. Home insurance safeguards property & personal belongings from unforeseen events, while life insurance ensures family members face financial stability after loss of a breadwinner.

Grasping nuances among various insurance types allows individuals & families alike to tailor coverage plans fitting their unique situations & risks they face. This foundational knowledge empowers anyone seeking better insurance solutions.

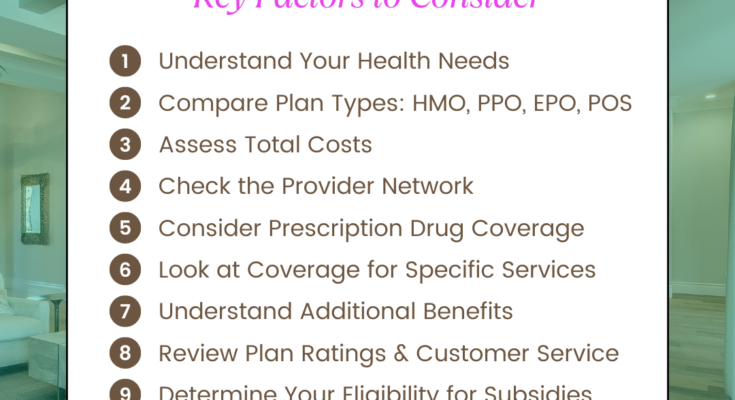

Assessing Your Insurance Needs

Assessing personal insurance needs represents a foundational step toward selecting appropriate policies. Begin by evaluating current assets, liabilities, lifestyle, & potential risks. This self-assessment enables one to uncover vulnerabilities requiring coverage.

Consider factors such as age, dependents, income level, & existing financial obligations when determining insurance requirements. Different life stages call for varying insurance solutions; thus understanding personal circumstances ensures optimal protection at all times.

A comprehensive analysis of insurance needs aids in avoiding both underinsurance & overinsurance. Proper planning helps allocate resources effectively based on genuine requirements rather than assumptions. Further, adjusting coverage through life changes keeps protection relevant.

Researching Insurance Providers

Thorough research of available insurance providers represents another essential step in selecting the right policy. Evaluate several insurance companies by examining their reputation, financial stability, & customer service performance. Reliable online reviews often shed light on previous clients’ experiences & satisfaction levels.

In addition, industry ratings from sources like A.M. Best or Moody’s provide valuable insights into financial strength. Such metrics contribute toward comparing existing providers while ensuring long-term stability of chosen companies.

Factor in local agent accessibility for ease of communication & support. Having reliable contact helps in managing claims, resolving issues, & clarifying policy details. The more informed one becomes about available options, better suitable selections are likely.

Comparing Insurance Quotes

Obtaining quotes from multiple insurers ensures comprehensive comparison opportunities. Collect quotes for similar coverage levels allows prospective buyers discern differences in pricing, exclusions, & benefits. This step serves as a practical approach toward budget-conscious decision-making.

Utilize online quote comparison tools or consult with local agents for streamlined access. Always focus on core components such as premiums, deductibles, & coverage limits during evaluations. Recurring themes often reflect market tendencies regarding given insurance types.

Keep notes during comparisons; systematic reviews aid in clearer decision-making & highlighting pros & cons among contenders. Evaluating quotes side-by-side can unveil hidden costs & valuable recommendations for achieving adequate protection.

Understanding Policy Terms

Understanding policy document nuances remains critical when selecting an insurance provider. Policies usually contain specific terms & conditions defining exclusions, limitations, & coverage specifics. Familiarity with insurance terminology enhances comprehension of what you purchase.

Some key terms require attention, such as premium, deductible, copayment, & coverage limits. Premium refers to payments made for coverage, whereas deductible amounts reflect upfront expenses before benefits kick in. Knowledge of these terms significantly influences user interaction with policies & insurers.

Don’t hesitate asking agents for clarification of vague terms or conditions. Every detail matters; ensuring complete comprehension avoids potential issues during claims processing. Always scrutinize fine print closely even if advice received seems credible.

Evaluating Customer Service Quality

Customer support quality often makes or breaks relationships with insurance companies. Assessing how insurers handle claims & inquiries provides insights into overall service standards. Timely assistance & effective communication can spell differences during times of increased stress.

Examine customer reviews concerning responsiveness & helpfulness. Consider how efficiently providers handle claims processing, as quick resolution yields positive experiences. A strong customer service focus indicates that businesses value client satisfaction & prioritize proactive solutions.

A valuable insurance provider not only offers robust coverage but also delivers unparalleled support. Therefore, prioritize customer service evaluation during decision-making, as strong service establishes rapport over long-term cooperation.

Considering Financial Stability

Financial stability plays a vital role while deciding on insurance companies. Researching insurer’s financial health yields insights into their ability to fulfill claims. Companies with poor financial standing may struggle when clients attempt to claim benefits.

Referencing third-party financial ratings offers essential guidance. Organizations such as A.M. Best or Standard & Poor’s provide evaluations reflecting insurers’ reliability & performance metrics. Always prioritize collaboration with financially stable firms ensuring peace of mind concerning claim payouts.

A solid financial foundation not only signals sound operational practices but reaffirms trustworthiness in times of crises. Choosing insurers with strong ratings reduces risks associated with unfulfilled claims or inadequate support during challenging periods.

Reviewing Exclusions & Limitations

Every insurance policy operates within defined limitations & exclusions dictating coverage scope. Reviewing these details ensures clients comprehend what remains uninsurable, guiding expectations accordingly. Knowing these aspects helps avoid surprises during claims submission.

Focus on common exclusions, such as pre-existing conditions in health plans or specific natural disasters for home insurance. Understanding limitations equips individuals with complete awareness of potential weaknesses linked directly with chosen policies.

Clients should engage providers requesting clarification around unclear exclusions. This proactive approach fosters transparency while informing personal risk management strategies going forward. Such awareness promotes educated decision-making during potential adverse situations.

Utilizing an Agent or Broker

Working alongside experienced agents or brokers often proves beneficial when navigating insurance choices. These professionals provide valuable guidance, recommending appropriate coverage based on individual needs. Their insights help streamline selection while maximizing saved time & effort.

Agents often represent particular insurance companies, whereas brokers operate independently, offering insights across numerous providers. Understanding differences enables better preparedness when seeking counsel regarding unique circumstances.

Leverage agents’ expertise during consultations; they frequently identify coverage gaps while suggesting suitable plans. Such engagement enhances personal insurance strategies tailored around life events ensuring consistent protection throughout various challenges.

Making a Decision

After thorough research, comparing quotes, & consulting professionals, determining strengths & weaknesses helps finalize decisions. Balance coverage needs with budget constraints while evaluating personal priorities fosters alignment among vying options.

Establishing a pros & cons list aids visualizing potential pitfalls related to certain policies. This straightforward visualization helps streamline choices & clarify what aligns most closely with overall goals.

Remember, selecting insurance remains a dynamic process; regular evaluations & adjustments reflect changing circumstances. Retain a proactive stance towards interactions with insurers, ensuring protection remains in place through life’s unpredictability.

Key Considerations When Choosing Insurance

- Identify specific coverage needs

- Research reputable insurance providers

- Get multiple quotes for comparison

- Understand key policy terms

- Evaluate customer service & support

- Consider financial stability of providers

- Review exclusions & limitations in policies

Personal Experience

During my quest for suitable insurance, I encountered various challenges & learning curves. Understanding intricate policy details proved daunting initially, but steady research enabled progress. Utilizing an agent helped clarify terms while identifying tailor-fit coverage. Ultimately, confidence emerged through informed decision-making, instilling peace of mind during uncertain times.

Insurance Types You Might Consider

- Health insurance plans

- Auto liability coverage

- Homeowner’s insurance policies

- Renters’ insurance solutions

- Term life insurance products

- Long-term disability plans

- Commercial insurance options

Factors Influencing Your Insurance Choices

- Budget constraints

- Risk assessments

- Family circumstances

- Long-term financial goals

- State regulations & requirements

- Marketplace trends

- Insurance company reputation

Insurance Policy Table Example

| Insurance Type | Average Premium | Typical Deductible |

|---|---|---|

| Health Insurance | $400/month | $2,000 |

| Auto Insurance | $100/month | $1,000 |

| Homeowner’s Insurance | $1,200/year | $1,500 |

Using Technology For Insurance Comparison

Modern technology simplifies insurance comparisons significantly. Online platforms & mobile applications facilitate easy access to multiple insurance quotes & providers. Some sites allow users input specific needs, generating personalized quote reports based on individual criteria.

Utilizing technology streamlines gathering required information efficiently. And another thing, many platforms include customer reviews & comparison tools, enabling informed decisions. An efficient online search can unlock competitive rates previously overlooked.

Consider digital applications offering reminders for renewal dates or policy adjustments. Staying engaged with insurance matters makes significant differences regarding coverage adequacy over time. Keeping up with technology keeps individuals aligned with changing landscapes.

Considering Environmental Factors

Environmental conditions might directly influence insurance types & coverage needs. For instance, residing in hurricane-prone areas necessitates specific policies accommodating natural disaster risks. Similarly, urban locations might experience higher theft rates, prompting more robust home insurance provisions.

Consider engaging regional experts familiar with local conditions when evaluating environmental factors. These professionals possess knowledge about common natural risks leading to relevant insurance suggestions. Collaboration ensures tailored solutions addressing real-world concerns affecting chosen policies.

Insurance & Life Changes

Life stages prompt reevaluation of existing insurance policies. Major events such as marriage, having children, or purchasing a home should trigger thorough assessments. Adapting to changing circumstances maintains applicable coverage as individual needs evolve.

Life changes often introduce new risks & responsibilities. For instance, a growing family might increase healthcare costs requiring better health insurance. Similarly, a new home may call for enhanced property insurance values & coverage limitations.

“Choosing **the right insurance** plays a pivotal role in providing stability during uncertainty.” – Financial Advisor

Claim Process Essentials

Understanding claim processes remains fundamental, ensuring smoother experiences whenever unforeseen incidents transpire. Familiarize yourself with necessary documentation & protocol prior to filing claims. Correct preparation prevents delays in address & payment during critical times.

Engage with customer support representatives proactively whenever questions arise regarding claim submissions. Familiarity with procedures fosters more robust interactions with claims & enhances overall awareness surrounding the complexities of utilization.

Regular follow-up following claim submission ensures transparent communications alongside prompt resolutions. Keeping diligent records showcases responsibility while helping mitigate potential challenges during claims processing. Emphasizing preparedness stands essential while handling unpredictable events.

Insurance Coverage Adjustments

Regular assessments prompt adjustments among personal insurance coverage. Reassess annually or after significant life changes; adjustments ensure ongoing relevance regarding policies & premiums. Regular updates prevent weaknesses linked directly to inadequate coverage settings.

Pay attention toward market changes as well as any shifting life perspectives that may adjust risks associated with existing policies. For instance, young adults entering homeownership might require different homeowners’ policies compared to renters.

Consider consulting with insurance agents periodically for expert advice regarding necessary adjustments. Expert insights present invaluable perspectives aligned with personal goals, ultimately optimizing protection consistently over time.

Advantage of Group Insurance Policies

Group insurance policies often yield cost-effective advantages not typically found in individual policies. Organizations such as employers may offer group policies ensuring lower premiums & more comprehensive coverage options compared with personal plans. These collective arrangements leverage purchasing power while minimizing financial strain.

Evaluating employer-based benefits represents a prudent approach toward enhancing overall protection. Often, these policies cover a wider range of services concerning health or life insurances, ensuring broader coverage for employees & families alike.

Understand eligibility requirements while considering group policies; participation in certain plans may hinge on employment status or membership within specific organizations. Utilizing group plans can bolster coverage while managing associated costs effectively.

Insurance & Retirement Planning

Insurance planning plays an integral role in successful retirement strategies. Long-term life insurance products or annuities maintain financial stability during retirement years. Investing in proper coverage secures peace of mind regarding future financial needs while safeguarding against unforeseen circumstances.

Retirement planning requires contemplation of various factors including unexpected health issues or rising living costs. Policies combined with strategic investments yield diverse channels ensuring consistent income streams throughout retirement duration.

Work alongside financial advisors & insurance agents establishing long-term plans tailored toward retirement goals. Collaborating enhances ensuring proactive measures mitigating risks while fostering security during life’s later stages.

Wondering how to choose the right insurance? Discover simple tips & advice to find the best coverage for your needs without the hassle!

Conclusion

Choosing the right insurance can feel overwhelming, but it doesn’t have to be. Start by knowing what you need & comparing options. Look for coverage that fits your lifestyle & budget. Don’t hesitate to ask questions; understanding your policy is key. Always read the fine print to avoid surprises later. Seek advice from trusted friends or professionals if you’re uncertain. Remember, the best insurance is one that protects you when it matters most. So take your time, do your research, & you’ll find the perfect fit for your needs. Happy hunting for your ideal insurance!