A career in insurance can be highly rewarding, offering stability, growth potential, & diverse opportunities. With the increasing complexity of financial needs, the demand for insurance professionals continues to rise. The industry provides a chance to build long-lasting client relationships while helping individuals & businesses safeguard their assets. And another thing, many companies offer competitive compensation, benefits, & opportunities for advancement. And don’t forget, skills acquired in the insurance sector, such as risk assessment & customer service, are transferable, making it a solid choice for long-term career development.

is insurance a good career choice. Is insurance a good career choice? Discover the benefits, job stability, & growth opportunities in the insurance career path for your future!

Understanding Insurance Careers

Exploring career opportunities within insurance sector reveals diverse paths available for those considering employment in this field. Professionals work in various roles such as underwriting, claims adjustment, & risk assessment. Each position presents unique challenges & opportunities that require different skill sets.

Entering insurance landscape involves understanding its various components. Candidates can find roles at insurance companies, brokerages, or even within corporate firms managing employee benefits. For individuals seeking job security combined with a chance for growth & advancement, considering this field may prove rewarding.

My personal experience working in insurance taught me a lot about this industry. Starting as a claims adjuster allowed me not just to develop technical skills, but also enhance my problem-solving abilities. Each day brought new challenges that heightened my adaptability & prepared me for future advocacy roles within fields related to insurance.

Career Growth Opportunities

Career advancement within insurance sector offers numerous paths, allowing professionals room for growth. Roles often lead into management positions, specialized roles in technology, or even consulting opportunities. Individuals who demonstrate commitment & skill tend to advance more rapidly, enabling more lucrative compensation packages.

Continuous education plays a vital role in facilitating career advancement. Obtaining relevant certifications, attending workshops, & pursuing higher degrees can significantly increase one’s marketability. Well-educated employees not only command higher salaries but also gain respect within their respective organizations.

Networking proves essential in this industry. Engaging with colleagues through seminars & industry conferences fosters relationships that aid career trajectories. Connections made often yield mentorship opportunities, covering nuances of business operations, & assisting in navigating professional landscapes.

Skills Required for Success

This field requires individuals to possess diverse skills ranging from analytical thinking, communication, negotiation, & customer service. One must evaluate various data points & communicate findings effectively to clients or stakeholders. Strong organizational skills are necessary to manage multiple tasks within often fast-paced environments.

Technical skills come into play as well. Understanding data analysis software, risk assessment tools, & insurance regulations foster efficient work practices. Professionals must adapt to technology trends continuously, ensuring they keep abreast of innovations that impact business processes & client interactions.

Interpersonal skills hold significant importance, given that individuals interact with clients & colleagues regularly. Building rapport & trust can lead to lasting relationships, potentially increasing business opportunities. Professionals with strong interpersonal skills often find themselves leading teams or managing client accounts directly.

Financial Stability in Insurance Careers

One can expect a stable career with decent compensation within this sector. Insurance professionals often earn competitive salaries that increase with experience & specialization. Many businesses offer attractive benefits packages, including retirement savings plans, health insurance, & paid time off.

And another thing, financial stability often aligns with job security, as demand for skilled workers within industry remains steady. While economic conditions may influence hiring practices, people typically require insurance regardless of market fluctuations. Thus, careers within this field maintain sustainability compared to others in fluctuating industries.

Salaries vary widely based on roles, geographical locations, & levels of experience. Entry-level positions may start at lower wages, while senior roles typically offer significantly higher compensation. As individuals gain relevant experience, salary potentials increase substantially.

Work-Life Balance Considerations

Finding an appropriate balance between personal life & professional commitments represents another crucial factor when considering any career choice. Many roles in insurance provide flexible working hours, allowing employees options beyond traditional 9-to-5 routines. Virtual positions are also available, enabling a work-from-home lifestyle.

Insurance professionals often experience predictable workloads compared to other sectors with unpredictable demands. This structure can lead individuals achieving a healthier work-life balance, promoting overall well-being. Flexible schedules enhance personal time management, allowing for responsibilities outside work hours.

Be that as it may, some positions may demand overtime during peak seasons, particularly for claims processing or underwriting with increased workloads. Understanding these fluctuations helps individuals prepare for expectations placed upon them while maintaining a constructive approach toward achieving work-life harmony.

Job Satisfaction in Insurance

Job satisfaction varies across different professions, yet many insurance professionals report a sense of fulfillment in their roles. Helping clients navigate complex situations or claims processes often leads individuals feeling rewarded diplomatically. Contributing positively connects them personally with their work, enhancing overall job satisfaction.

Working within this industry can offer engagement opportunities by tackling diverse challenges daily. Each case presents unique scenarios requiring adaptable solutions. Overcoming obstacles fosters a sense of accomplishment, boosting motivation while remaining challenged.

And another thing, this field prioritizes ethical practices, integrity, & professionalism. Insurance professionals often pride themselves on representing their clients’ interests during claims or policy negotiations. Such values contribute significantly toward fostering job satisfaction among individuals committed to serving others.

Potential Drawbacks to Consider

Just like any career, pursuing work in insurance carries potential downsides. Job pressures, including meeting strict deadlines & achieving performance targets, may lead individuals feeling overwhelmed. High-pressure environments cause stress, particularly during peak claim seasons where large volumes of work demand efficiency.

And another thing, some job positions involve repetitive tasks that may lead to boredom over time. Candidates who thrive on variety might find certain roles mundane, particularly those focused on data entry or policy management. Seeking diverse opportunities may be crucial for personal satisfaction in insurance career paths.

Job prospects & growth opportunities also depend heavily on location. Certain regions may offer limited roles available, causing competition among candidates. Individuals residing in these areas may face challenges moving up within their careers unless willing to relocate for advancement.

Educational Requirements for Insurance Careers

Gaining pertinent educational qualifications represents a critical step when pursuing a career within insurance sector. Many employers prefer candidates with at least a bachelor’s degree in fields like finance, business administration, or risk management. Specialized degrees could enhance one’s prospects further.

Certification programs are available through respected organizations, affording professionals additional credentials. Notable designations include Chartered Property Casualty Underwriter (CPCU) & Certified Insurance Counselor (CIC). Attaining these credentials demonstrates commitment & expertise within one’s chosen discipline.

Continuous learning remains pertinent, with industry trends evolving regularly. Online courses, workshops, & seminars allow individuals staying relevant. Keeping up with certificates & ongoing education can set one apart from peers, enhancing career growth opportunities.

Important Tools & Technologies

Technology adoption across industries reshapes how businesses operate, & insurance sector embraces this evolution. Professionals utilize various software platforms that assist in managing claims, underwriting policies, & assessing risk efficiently. Familiarity with tools commonly used within field ensures smooth operations.

Data analysis tools serve an essential role within insurance careers, helping professionals evaluate large datasets & derive meaningful insights. Understanding predictive analytics & risk modeling software elevate one’s skills, enabling efficient decision-making & improved risk assessment capabilities.

And another thing, customer relationship management systems, known as CRMs, allow professionals managing client information effectively, enhancing communication channels & service delivery. These tools play a fundamental role in maintaining client satisfaction & securing future business engagements.

Exploring Different Roles in Insurance

- Underwriter

- Claims Adjuster

- Insurance Agent

- Risk Manager

- Actuary

Roles with High Earning Potential

| Position | Average Annual Salary | Job Growth Rate |

|---|---|---|

| Actuary | $110,000 | 20% |

| Underwriter | $70,000 | 5% |

| Claims Adjuster | $60,000 | 3% |

Direct Paths of Advancement

- Claims Manager

- Senior Underwriter

- Director of Risk Management

- Insurance Broker

- Compliance Officer

Networking & Professional Development

Engaging with industry peers nurtures professional relationships, leading toward fruitful career advancements.

Building a broad network through industry events, workshops, or social media channels becomes crucial for those pursuing careers in this sphere. Establishing connections offers valuable insights & opportunities for collaborations, enhancing one’s understanding of prevalent trends & best practices.

Participating in local insurance associations or online forums promotes knowledge sharing between experienced professionals & newcomers alike. These platforms serve excellent opportunities for mentorship, where seasoned individuals guide entrants navigating complexities of insurance landscape.

Continued involvement within industry bodies provides useful resources aimed at enhancing professional development. Regular learning opportunities might include certifications, specialized training, & workshops focusing on emerging trends. Engaging consistently builds professionalism & further ensures success in this vibrant field.

Final Thoughts on Career Choices within Insurance

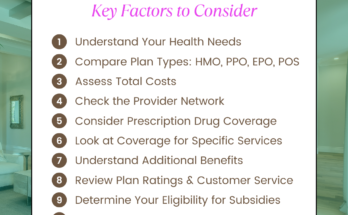

Summarizing insights about pursuing careers in insurance highlights significant factors for consideration. Seeking stability, professional development, & job satisfaction often leads individuals evaluating options to firmly regard this field as viable. Understanding various roles, requisite skills, & earning potentials further shapes informed decision-making processes.

Individuals drawn toward analytical tasks, problem-solving, & customer engagement may find fulfillment within this unique industry. And don’t forget, cultivating meaningful relationships through networking, continuous learning, & professional development ensures thriving careers for those committed & passionate.

Is insurance a good career choice? Discover the benefits, job stability, & growth opportunities in the insurance career path for your future!

Conclusion

In conclusion, choosing a career in insurance can be a smart move for many reasons. It offers job stability, growth opportunities, & the chance to help people protect what matters to them. If you enjoy working with others & solving problems, this field might be a perfect fit. And another thing, the flexibility & various roles within the insurance industry can cater to different interests & skills. Ultimately, if you’re looking for a rewarding & dynamic career, insurance could be a great choice for your future! So why not explore it further?