Insurance faces several challenges, including rising claims costs due to natural disasters & health crises, which strain providers’ financial stability. And another thing, the complexity of policies & varying regulations complicate consumer understanding & access. Fraudulent claims increase costs for insurers, impacting premiums for honest policyholders. Technological advancements necessitate continuous investment in systems & cybersecurity. And don’t forget, changing demographics & climate change introduce unpredictability in risk assessment, making it difficult for insurers to price products accurately & maintain profitability while providing comprehensive coverage.

what are the challenges of insurance. Discover the challenges of insurance in simple terms. Understand common issues like affordability, coverage gaps, & claim frustrations. Let’s explore!

Understanding Challenges in Insurance

In navigating various insurance options & decisions, individuals encounter numerous obstacles. Having gone through this experience myself, I can certainly relate well. At times, managing policies, comprehending terms & assessing coverage can feel progressively overwhelming.

Complex Regulatory Environment

Insurance operates within a framework of regulations that vary by country & region. These regulations can impose significant challenges on insurers & policyholders alike. Insurers must navigate an intricate maze of rules, which not only affects their operational processes but also impacts customers’ experiences. A constant evolution of regulations leads to difficulties in compliance, creating an environment of uncertainty & confusion.

On top of that, frequent changes in regulations can burden smaller insurance companies, making compliance costly & resource-intensive. These smaller entities might struggle against giants with greater funding. This often leads to increased premiums for customers, as firms strive to meet regulatory demands while remaining competitive in pricing.

Policyholders might also experience challenges stemming from regulatory changes. New laws can shift coverage requirements, leaving consumers unsure whether existing policies still meet necessary standards. Such unpredictability can create dissatisfaction among consumers, who might feel unprotected or misinformed.

Key Issues in Regulatory Compliance

- Frequent changes in regulations

- Variability across regions

- Compliance costs for smaller firms

- Burden of understanding legal jargon

- Impacts on premium pricing

Market Competition

Competitive pressures shape insurance market dynamics. Insurers often resort to aggressive marketing tactics, causing confusion among potential clients. While competition can lower prices, it can also lead insurers to compromise on their coverage quality. Such practices can undermine consumer trust.

And another thing, firms may leverage technological advancements such as AI & data analytics, allowing them to undercut premiums. These strategies frequently leave customers questioning value received versus price paid. As customers, understanding which coverage truly provides adequate protection becomes cumbersome.

And don’t forget, a saturated market may result in an overwhelming number of options for consumers. This abundance can lead to analysis paralysis, where potential buyers feel immobilized by choices. Selecting suitable policies aligned with personal needs can become daunting in such environments.

Challenges Posed by Market Competition

- Confusion from aggressive marketing

- Quality compromises in coverage

- Rise of analysis paralysis

- Trust issues among consumers

- Technological disparities in access

Consumer Misinformation

In an industry marked by complexities, misinformation frequently emerges. Numerous consumers lack a solid understanding of policy terms & conditions. Insurers sometimes compound this issue by employing jargon that only experts can decipher. This creates an environment ripe for misunderstanding & miscommunication.

Social media & online platforms also contribute to spreading inaccurate information regarding coverage options & benefits. Consumers may base their decisions on anecdotal evidence or unverified claims, leading to poor choices. Such misinformation can cost individuals valuable time & money.

Efforts to educate consumers must become a priority across insurance entities. Simplified language, transparent communication, & easily accessible resources can foster understanding. Insurers must strive for clarity, ensuring their clients truly grasp what they’re purchasing.

Misinformation Challenges

- Complex jargon alienating customers

- Inaccurate information on social media

- Decision-making based on anecdotes

- Lack of resources for consumer education

- Poor communication from insurers

Technological Adaptation

With advancements in technology, insurance firms face challenges in adopting new systems effectively. Digital transformation demands substantial investments, both financially & in terms of time. Smaller firms in particular may find this hurdle insurmountable, stunting innovation & growth potential.

On top of that, as consumers increasingly rely on digital platforms for transactions, their expectations for seamless experiences rise correspondingly. Insurers must adapt quickly, ensuring their digital interfaces are user-friendly. Failure to meet these expectations can drive potential customers away, adversely affecting market share.

Cybersecurity represents another pivotal aspect. As insurance data collection becomes increasingly sophisticated, protecting sensitive consumer information becomes paramount. Firms must invest heavily in security measures, as data breaches can lead to devastating reputational damage & legal liabilities.

Technological Adaptation Challenges

- High costs of digital transformation

- User experience expectations rising

- Cybersecurity risks & implications

- Resistance from traditional firms

- Need for employee training

Claims Management Difficulties

Claim processes often represent a significant pain point for insurance customers. Typically, consumers face delays when seeking reimbursement or resolution for claims. Insurers may require extensive documentation & thorough investigations, creating roadblocks that frustrate clients.

And another thing, disputed claims can further complicate matters. Policyholders may feel skeptical when insurers deny claims, questioning whether they possess adequate coverage. Such disputes can lead customers to feel alienated & dissatisfied, potentially resulting in lost business for insurers.

The consistent need for improved transparency within claims management must become a priority. Clear guidelines regarding document requirements & realistic timelines can build much-needed trust between consumers & insurers. Creating open channels of communication is essential for resolving discrepancies & enhancing customer satisfaction.

Challenges of Claims Management

- Delays in claim processing

- Disputed claims creating cynicism

- Lack of transparency in documentation

- Inadequate communication from insurers

- Inconsistent claim outcomes

Pricing Challenges

Insurance pricing remains a contentious issue for both consumers & providers. Premiums often fluctuate based on factors such as age, health, & location, creating confusion. Consumers may find it difficult to understand why premiums differ significantly across providers, leading them to question fairness in pricing.

Risk assessment models developed by insurers can also present challenges. While statistical data guides premium determination, unique individual circumstances may not always reflect accurately in these assessments. Consequently, some customers may face exorbitant rates despite being low-risk individuals.

On top of that, economic fluctuations such as inflation can impact overall pricing strategies. As costs of medical treatments, repairs, or liabilities increase, insurers often adjust premiums accordingly. This can lead to frustration & dissatisfaction among consumers already facing rising living expenses.

Pricing Challenges

- Fluctuating premium rates

- Confusion in pricing fairness

- Risk assessment inaccuracies

- Impact of economic fluctuations

- Lack of affordability for consumers

Customer Retention Issues

Amid intense competition, retaining customers poses significant challenges for insurance providers. With numerous choices available, clients often switch providers looking for better services or lower premiums. This not only impacts profitability but also creates instability in client relationships.

Insurers must implement robust customer loyalty initiatives that foster retention. Building rapport through excellent customer service, personalized offerings, & effective communication can yield positive results. And another thing, providers must continually assess their value propositions, ensuring offerings align with evolving consumer expectations.

And don’t forget, understanding reasons behind customer churn can facilitate meaningful changes within an organization. Regular feedback mechanisms such as surveys can be instrumental in discovering pain points & areas requiring improvement. Harnessing this insight subsequently allows firms to fine-tune customer experience strategies.

Challenges in Customer Retention

- High levels of market competition

- Client loyalty lacking

- Need for excellent customer service

- Dynamic consumer expectations

- Importance of regular feedback

Financial Management Difficulties

Successful financial management remains crucial within insurance companies. Disbursement of claims must align with cash flow while maintaining profitability. Inadequate financial oversight can jeopardize operations, leading to insolvency if firms cannot meet claims obligations.

On top of that, fluctuations in investment returns can create instability. Insurance companies typically invest premiums in various markets, hoping for high returns. Be that as it may, economic downturns can lead to significant losses, which may impact their ability to pay claims.

Effective risk assessment practices must remain a priority for insurers. Accurately predicting long-term liabilities alongside financial health necessitates astute management skills. Strong financial strategies safeguard company futures while maximizing customer satisfaction.

Challenges in Financial Management

- Cash flow versus claims obligation balance

- Investment return fluctuations

- Long-term liability predictions

- Inadequate financial oversight

- Importance of strong financial strategies

Socio-Economic Factors Impacting Insurance

Socio-economic trends significantly influence insurance industries, creating challenges in product offerings & market accessibility. Variations in income levels & education create disparities in insurance literacy, leading certain demographics lacking coverage options.

Economic instability, including recessions or wage stagnations, directly affects consumers’ ability to purchase insurance. Financial hardships often force individuals to prioritize essential expenses, pushing insurance coverage lower on their lists. As a result, this can increase risks for both consumers & insurers alike.

Market adaptation becomes vital as insurers must accommodate diverse customer needs influenced by socio-economic dynamics. Tailoring products & services to match different income segments fosters inclusivity while expanding market reach.

Challenges from Socio-Economic Factors

- Disparities in insurance literacy

- Economic instability affecting purchases

- Need for tailored products

- Financial hardships limiting coverage

- Diverse demographic needs

Environmental Risks & Insurance

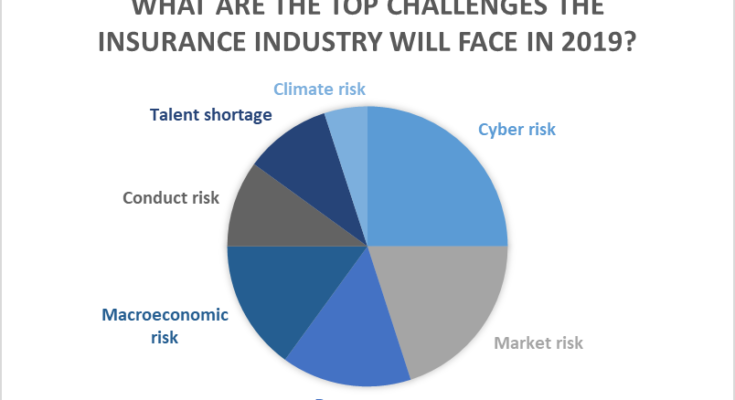

Increasing environmental challenges present new obstacles for insurance providers. Climate change, natural disasters, & unpredictable weather patterns lead insurers grappling with heightened risks. These conditions can significantly impact premiums & coverage options.

On top of that, rising claims associated with environmental hazards can strain resources. Insurers face difficulties in accurately pricing policies reflective of such risks while ensuring profitability. Adjustments in underwriting practices may also become necessary as new data emerges regarding environmental impacts.

Long-term strategies must incorporate environmental considerations. Insurers must develop resilience frameworks that mitigate risks associated with climate change while maintaining a commitment towards sustainability. Such initiatives ultimately benefit consumers while safeguarding company futures.

Environmental Risk Challenges

- Rising claims from environmental hazards

- Increasing difficulty in pricing policies

- Changing underwriting practices

- Need for resilience frameworks

- Commitment towards sustainability

| Challenge | Impact on Insurers | Impact on Consumers |

|---|---|---|

| Regulatory Changes | Increased compliance costs | Uncertainty in policy coverage |

| Misinformation | Trust erosion | Confusion in decision-making |

| Market Competition | Pressure on pricing | Difficult choice environments |

| Challenge Area | Key Challenge | Potential Solutions |

|---|---|---|

| Claims Management | Delays in processing | Streamlined documentation processes |

| Customer Retention | High churn rates | Loyalty programs |

| Technological Adaptation | Cybersecurity risks | Robust security frameworks |

“Navigating through insurance obstacles often leads individuals feeling overwhelmed & confused, impacting their overall satisfaction with providers.”

Discover the challenges of insurance in simple terms. Understand common issues like affordability, coverage gaps, & claim frustrations. Let’s explore!

Conclusion

In summary, the world of insurance comes with its own set of challenges. Many people struggle to understand the various policies & coverage options available, which can lead to confusion. And another thing, rising costs & complicated claims processes add to the frustration. Insurance companies also face challenges, such as managing risk & staying competitive. As we move forward, it’s essential for both consumers & insurers to openly communicate & seek clarity. By addressing these hurdles together, we can create a smoother experience for everyone involved in the insurance journey.