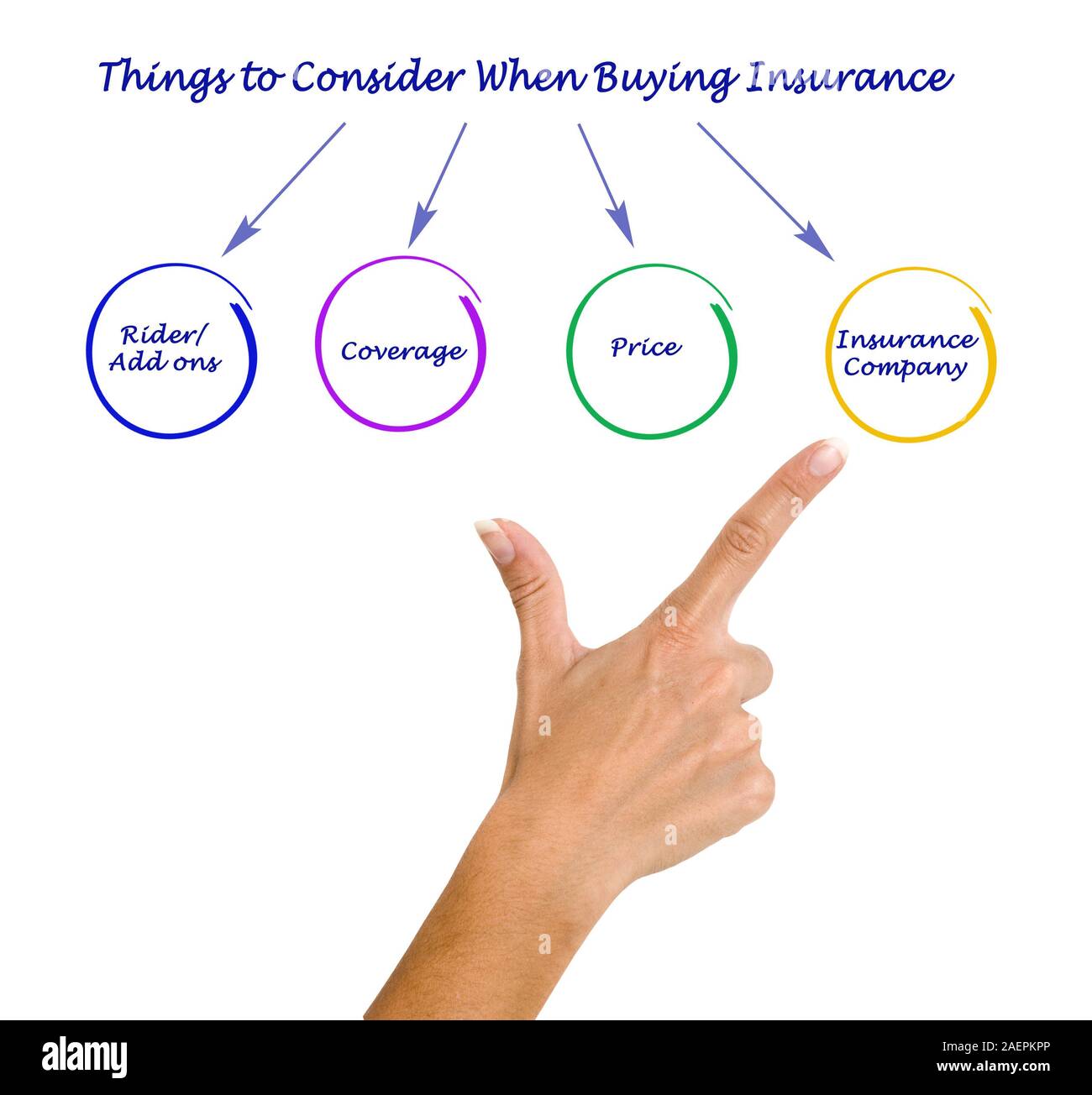

When buying insurance, consider your specific needs, such as coverage types, policy limits, & deductibles. Evaluate the insurer’s reputation, financial stability, & customer service through reviews & ratings. Compare premiums from multiple providers to ensure you’re getting the best value, while also examining any exclusions or conditions in the policy. And another thing, think about how your life circumstances may change in the future & whether the policy can adapt accordingly. Finally, consult with an insurance agent for personalized guidance & clarity on complex terms.

what to consider when buying insurance. When buying insurance, consider premiums, coverage, & customer service. Choose wisely for peace of mind & the best protection for your needs!

Understanding Insurance Types

When considering insurance options, a significant factor involves understanding different types available. Each type serves unique needs & protects against specific risks. Familiarity with these categories empowers consumers to select appropriate coverage.

Common types include health insurance, auto insurance, homeowners insurance, life insurance, & travel insurance. Each type varies in policy features, costs, & exclusions. Carefully analyzing each option ensures informed choices, particularly concerning personal situations.

And another thing, insurers offer various plans within each type of coverage. For example, health insurance may range from basic plans covering essential services, such as doctor’s visits & hospitalization, to comprehensive plans offering extensive benefits, including mental health coverage & preventive services. Evaluating these elements contributes greatly to making smart decisions regarding insurance purchases.

Assessing Coverage Needs

Determining appropriate coverage involves careful consideration of individual & family needs. Each person’s requirements fluctuate based on circumstances, such as existing health issues, financial situations, or family size. Reflecting on current & future situations guides this assessment.

A personal experience surrounding this involved evaluating homeowners insurance. Initially, I underestimated replacement costs in case of damage. Be that as it may, thorough assessment revealed necessity for higher coverage than expected. This experience highlighted importance of measuring personal needs accurately when selecting insurance.

On top of that, engaging with professionals for guidance may be beneficial. Speaking with agents can provide insights tailored specifically for unique situations. They may also inform clients about minimum coverage mandated by law or recommended based on risk evaluation. Thus, clients can adequately protect themselves through appropriate policies.

Identifying Core Coverage Areas

- Property Damage

- Liability Protection

- Health Care Expenses

- Vehicle Protection

- Disability Coverage

Evaluating Costs & Premiums

Another crucial aspect involves understanding insurance costs. Premiums can vary significantly based on coverage selected, amenities offered, & even individual risk factors. Different companies may impose different premium rates, necessitating detailed comparison across options.

When evaluating costs, individuals must also consider deductible amounts. A deductible represents a specified amount paid out-of-pocket before coverage kicks in. Aim for balance between manageable premiums & an acceptable deductible that fits budgetarily.

Insurers frequently offer discounts based on certain factors, such as bundling multiple policies or maintaining a clean record. Exploring opportunities for savings plays a pivotal role in reducing overall expenses associated with insurance. Different pricing models can lead to substantial variations, so thorough research yields optimal results.

Comparing Policies

- Types of Coverage Available

- Exclusions Mentioned

- Limits Imposed on Claims

- Discount Opportunities

- Insurer Reputation

Researching Insurers

Researching prospective insurers represents a vital component during purchasing phase. Not all companies provide equal levels of service or coverage. Thus, concentrating on reputable insurers with positive customer feedback ensures clients receive quality support & benefits.

Checking ratings from reputable organizations allows individuals insight into financial stability & customer satisfaction. Many sources, including consumer reports & independent rating agencies, evaluate insurers on various criteria, including claims handling efficiency, response times, & overall customer service experience.

And another thing, discussing experiences with friends, family, or colleagues can yield valuable recommendations. Personal testimonials often reflect true experiences & reveal nuances that ratings may not encompass. Engaging actively with resources mitigates potential risks involved with choosing a less-than-ideal insurer.

Factors Impacting Insurance Costs

| Factor | Impact on Costs |

|---|---|

| Age | Older individuals typically receive lower premiums. |

| Location | Areas prone to natural disasters may encounter higher rates. |

| Driving Record | A clean driving history can lead to lower auto insurance costs. |

| Credit Score | Higher credit scores generally result in reduced premiums. |

| Claims History | Frequent claims may increase future premiums significantly. |

Understanding Policy Features

Policies vary regarding specific features included. Common elements typically include deductibles, limits, & exclusions. Clarity regarding these aspects plays an essential role in preventing surprises during claims processes. Carefully dissecting policy documents ensures that consumers grasp what’s covered & what’s not.

Collectively understanding how coverage works including definitions of terms such as comprehensive & collision enhances knowledge. Each policy’s precise wording matters significantly; thus, consumers should read documents thoroughly or consult agents for clarification whenever necessary.

Additional features like riders or endorsements may offer enhanced coverage at an additional cost. These optional add-ons can extend protection beyond standard policies. For those requiring extensive coverage, investing in these enhancements becomes worthwhile.

Key Policy Features

- Deductibles Explained

- Policy Limits Overview

- Exclusions Overview

- Additional Riders Available

- Renewal Terms Details

Understanding Claims Process

Recognizing claims processes particularly significant for consumers. A clear understanding dictates how quick funds or assistance may become accessible during emergencies. Each insurer implements distinct procedures & documentation standards, thus requiring clients’ diligence.

Filing a claim usually necessitates detailed documentation, including receipts, police reports, or doctor’s notes, depending on coverage type. Understanding these requirements beforehand prepares insured individuals for swift action when needed.

On top of that, comprehension of timelines surrounding claims processing holds weight. Some insurers process claims faster than others, impacting how soon clients receive payouts. Verifying expected timelines & responsiveness during initial consultations with insurance agents builds peace of mind.

Claims Process Insights

| Step | Description |

|---|---|

| Claim Notification | Report incident promptly through designated channels. |

| Documentation Submission | Submit all requested documents & evidence for claims. |

| Claim Assessment | Insurers evaluate submitted information for validity. |

| Decision Communication | Insurer informs client about claims decision & payout. |

| Payout Processing | Receive payment based on claims approval & policy terms. |

Identifying Exclusions & Limitations

All policies contain exclusions specific events or situations not covered. Understanding these exclusions enhances client readiness for potential situations that unfold. Reviewing this aspect carefully ensures individuals remain informed about specific risks to avoid when selecting plans.

Common exclusions encompass natural disasters, pre-existing conditions in health insurance, & damages resulting from reckless behavior. Being well-versed in these can prevent financial pitfalls during critical times. Thorough analysis of these conditions shapes responsible decision-making.

And another thing, limitations regarding payout amounts directly influence consumer preparedness. Many policies specify maximum limits on certain claims or coverage types. Knowing these limitations aids insured individuals in planning adequately for unforeseen events.

Exclusions Overview

- Natural Disasters

- Pre-existing Medical Conditions

- Intentional Damages

- Negligence Factors

- Wear & Tear Issues

Seeking Professional Advice

In many instances, consulting professionals becomes essential when navigating complex details surrounding insurance. Professionals can provide critical insights, ensuring clients grasp nuances related to policies, costs, & necessary coverage levels. They serve as invaluable resources throughout decision-making phases.

Finding a qualified insurance agent or broker provides guidance tailored for specific needs. Agents often bring wealth of knowledge & experience, capable of offering personalized advice. This expertise proves beneficial, especially for individuals unfamiliar with insurance terminology or requirements.

On top of that, individuals can engage in online forums or communities dedicated to insurance discussions. Participating in these networks offers opportunity for sharing experiences & learning from others’ journeys. Harnessing collective knowledge leads to more informed decisions about insurance coverage.

“Understanding your insurance needs before committing to a policy allows for better protection & peace of mind.”

When buying insurance, consider premiums, coverage, & customer service. Choose wisely for peace of mind & the best protection for your needs!

Conclusion

When you’re thinking about buying insurance, keep it simple. First, figure out what you need like health, auto, or home insurance. Then, compare different plans to see which one suits your lifestyle & budget best. Don’t forget to read the fine print; it’s crucial to know what’s covered & what’s not. Also, consider the deductibles & premiums balancing these can save you money. Lastly, check the company’s reputation for customer service. A solid choice now means peace of mind later, so take your time to choose wisely! Your future self will thank you.