Insurance & investment serve different purposes & one isn’t inherently better than the other; rather, they complement each other. Insurance provides financial protection against unforeseen events, safeguarding your assets & providing peace of mind. In contrast, investment focuses on wealth accumulation over time, aiming for growth & financial returns. Choosing between them depends on individual goals: if security is a priority, insurance is essential; if growing wealth is the aim, investment offers greater potential returns. A balanced financial strategy often involves both, ensuring protection & capital growth.

which is better insurance or investment. Is insurance better than investment? Discover the pros & cons of each to find out which one suits your needs best. Let’s simplify your choices!

Understanding Insurance

Understanding insurance involves recognizing its purpose, mechanisms, & advantages. Insurance serves as a risk management tool, protecting individuals & businesses from potential financial losses. Many people use various types of insurance policies depending on needs, including health, auto, property, & life. Each insurance type comes with its own benefits & coverage limits.

My personal experience with insurance has encompassed different policies throughout life. From car, health, & home insurance, every decision revolved around feeling secure about potential risks. Balancing premiums against coverage sometimes led me to wonder whether this approach sufficed versus alternative methods like investing.

On top of that, evaluating claims processes across different providers often revealed substantial variances in outcomes. Some companies processed claims efficiently, while others presented hurdles that dampened customer satisfaction. Assessing these aspects plays a crucial role when determining which option insurance or investment holds greater value for consumers.

Exploring Investment Options

Investment refers essentially to allocating resources, usually money, into ventures expected to yield profit over time. Various options exist under this category, each providing unique benefits & risks. Popular forms include stocks, bonds, real estate, & mutual funds. Individuals often choose investments based upon risk tolerance, time horizon, & financial goals.

Having explored multiple investment avenues myself, I’ve observed varying outcomes based on market conditions & decision-making processes. Engaging with stocks offered exhilarating highs & teachable lows, while investments in real estate promised more stability both approaches highlighted distinct experiences shaped by personal circumstances.

Understanding how each investment aligns with individual financial objectives remains essential. Not all investments suit every personality or financial status; balancing risk & reward plays a significant role, making informed decisions crucial for success.

Benefits of Insurance

Choosing insurance offers numerous advantages that cater to unique needs. First, peace of mind comes from knowing potential risks are covered. Life, health, & property coverage helps mitigate financial impacts from unforeseen events. This protection fosters a sense of stability, allowing individuals to focus on life goals without constant worry about unexpected catastrophes ensnaring them.

And another thing, many forms of insurance provide tax benefits, contributing further incentives for policyholders. Depending on specific conditions, premiums for particular policies may qualify for deductions during tax time. Utilizing this advantage can lead to overall savings as well as an enhanced financial landscape.

Finally, insurers often offer additional services, such as health & wellness programs or financial advice, which enhance overall value of coverage. These services might help policyholders gain insights regarding health, financial management, or wellness strategies that improve quality of life & potentially reduce future claims.

Advantages of Investment

Investing holds significant appeal for individuals seeking long-term wealth accumulation. One of main benefits rooted in understanding compound interest, where money earns interest not only on initial capital, but also on accrued earnings. Over time, this can lead to exponential growth, outperforming many insurance products in return metrics.

And another thing, investments offer liquidity, unlike certain insurance policies that feature strict withdrawal conditions. Stocks, for instance, allow individuals access to cash relatively quickly when needed. This flexibility can play an integral part in financial planning, enabling timely responses to opportunities or emergencies.

On top of that, various investments permit diversification spreading capital across different sectors or asset classes mitigates risk. A well-balanced portfolio minimizes potential losses during downturns while maximizing potential gains during bull markets, showcasing a fundamental principle of investing.

Comparing Security & Wealth Growth

The core distinction between insurance & investing lies in original purpose: one primarily addresses security while other aims for wealth growth. Insurance provides a safety net against risks, whereas investments cultivate potential for financial accumulation. Recognizing this fundamental difference serves critical when assessing which path aligns better with individual objectives.

Individuals seeking protection against financial loss generally gravitate toward insurance. In contrast, those focusing on building long-term wealth may prefer exploring diverse investment opportunities. Ultimately, both options serve important roles within financial planning, making informed decisions crucial based upon personal circumstances.

And don’t forget, assessing an individual’s unique financial situation can provide insight into which option may yield greater rewards. Professionals often recommend a balanced approach, combining elements of both insurance & investing, acknowledging each plays significant roles throughout life stages.

Which Option Provides Better Returns?

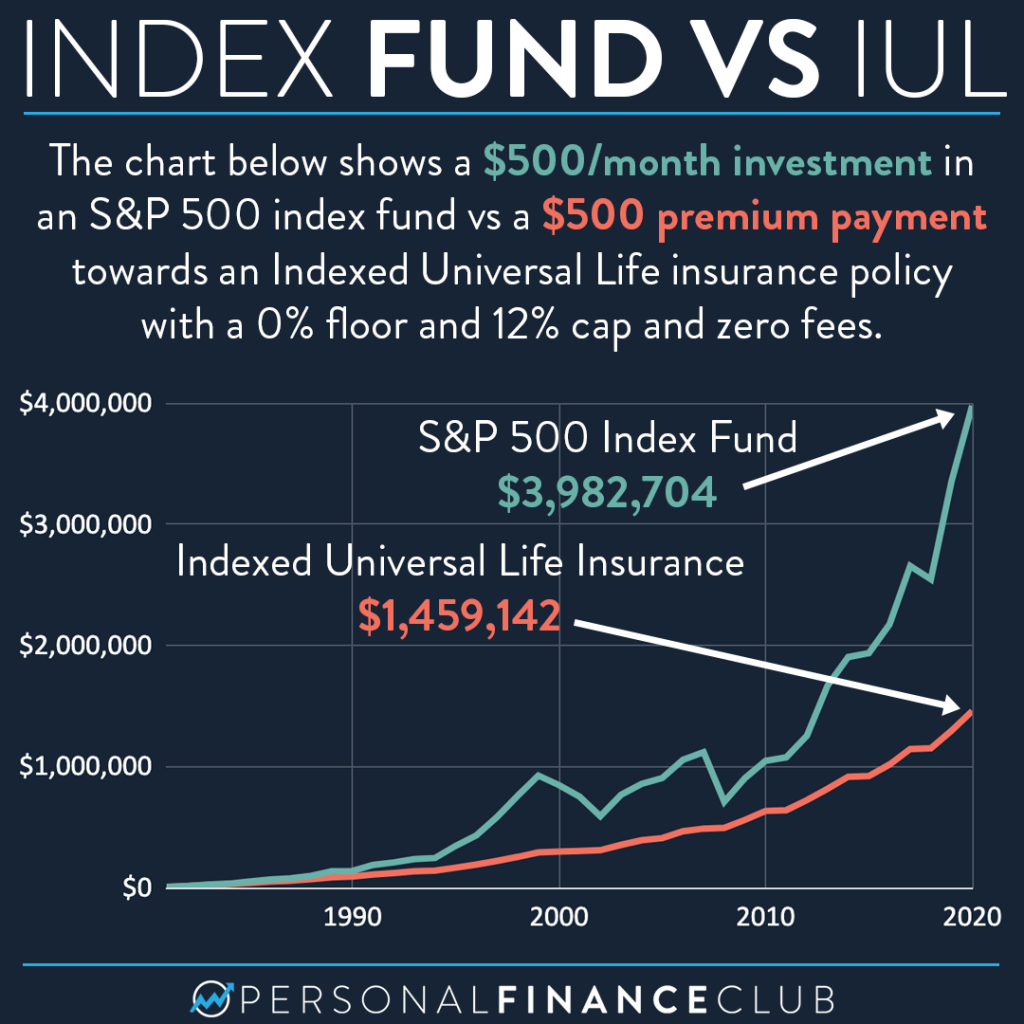

Evaluating returns becomes essential when determining superiority between insurance & investment. Typically, investments yield higher returns over longer periods. An analysis of various investment options often reveals more favorable outcomes compared with static returns associated with traditional insurance policies. This can be pointedly highlighted through market performance trends that showcase growth over time.

Comparing average annual returns between investment types might emphasize differences. Stocks regularly outperform traditional savings or insurance products. Therefore, assessing potential overall gains becomes imperative when deciding which route aligns with financial aspirations.

Potential Investment Returns

- Stocks: 7-10% average annual return

- Bonds: 3-5% average annual return

- Real Estate: 8-12% average annual return

- Mutual Funds: 6-9% average annual return

- Index Funds: 7-10% average annual return

Insurance Growth Factors

- Whole Life Insurance: 3-5% cash value growth

- Universal Life Insurance: 3-6% cash value growth

- Term Life Insurance: No cash value growth

- Variable Life Insurance: Tied to market performance

- Return of Premium Policies: Returns premiums after specific term

Long-Term vs Short-Term Considerations

Deciding between insurance & investing frequently hinges upon time perspective. Insurance often caters towards unforeseen events or short-term needs, ensuring immediate protection. Conversely, investing emphasizes long-term growth strategies focused on wealth accumulation, providing significant returns when approached correctly.

Individuals might find that their financial positions fluctuate over time. For example, young professionals may prioritize building wealth through investing, while families might lean towards purchasing insurance policies that secure their future. Over decades, these priorities could shift as situations evolve.

Flexibility within financial planning allows individuals to adapt better based upon personal objectives. Especially during periods of economic uncertainty, re-evaluating priorities aids in effectively balancing insurance & investment strategies.

Risk Assessment in Both Approaches

Assessing risk serves integral within discussions surrounding insurance & investing. While both options entail associated risks, differences exist in our understanding & management of these factors. Insurance typically mitigates risk through premiums paid, which establishes security against unforeseen events, such as accidents or health issues. Be that as it may, those premiums can evolve, introducing variability for policyholders.

Investment risks, on other hand, arise from market fluctuations, economic downturns, & individual decision-making. Familiarizing oneself with these risks becomes vital when selecting suitable investments engaging with financial advisers or industry professionals shapes better-informed approaches.

As experienced investors know, diversification reduces risks associated with investment portfolios. By spreading capital across varied asset classes & sectors, individuals minimize potential losses that arise from market instability, emphasizing importance of vigilance throughout investment journeys.

The Psychological Factor

Understanding psychology plays a crucial role in choosing between insurance & investing. Many people find comfort in insurance policies, which represent a safety net & asset protection strategy. Individuals often feel reassured knowing that coverage exists, especially during times of insecurity.

Investment decisions, Be that as it may, can invoke fear, anxiety, & uncertainty triggered by market volatility. Emotional responses frequently cloud judgment when it comes time for decision-making, leading individuals astray. Successful investors often emphasize following disciplined strategies while avoiding knee-jerk reactions, promoting healthy mindsets during challenges.

Balancing insurance & investments within one’s portfolio can also ease psychological stress. Providing both security & opportunity allows individuals peace of mind, knowing they’ve secured future while simultaneously promoting growth. Striking this balance fosters confidence in achieving financial goals.

Smart Strategies for Financial Planning

Integrating both insurance & investing into financial plans remains paramount. Engaging in thorough research helps ascertain suitable options that align with personal goals. Creating stable foundation requires careful evaluation of individual needs, understanding risk tolerance alongside one’s unique circumstances.

Consulting with financial advisors proves advantageous, offering valuable insights into optimal strategies for portfolio diversity. These professionals help navigate complex insurance products while illuminating potential investment pathways which ultimately serve individual aspirations.

Considering future life stages often shapes effective financial strategies. A young professional may prioritize investments while gradually integrating insurance products, while mid-career families might explore comprehensive plans designed for protection throughout life’s dynamic changes.

Comparative Table of Returns

| Investment Type | Average Annual Return |

|---|---|

| Stocks | 7-10% |

| Bonds | 3-5% |

| Real Estate | 8-12% |

Insurance Policies & Their Benefits

| Insurance Type | Key Benefits |

|---|---|

| Health Insurance | Access to medical services |

| Life Insurance | Financial security for dependents |

| Home Insurance | Protection against property loss |

Concluding Thoughts on Choosing Between Both

Both insurance & investing provide critical components within personal finance. Decisions regarding which option prevails often pivot around individual circumstances, including lifestyle, personal needs, & long-term aspirations. Performing thorough research enables individuals to make educated decisions grounded in knowledge & experience.

Ultimately, engaging with both options forms an all-encompassing strategy that incorporates security & wealth growth, promoting overall financial health. Striking that balance remains a personal journey that varies from one individual to another, dictated by unique priorities & objectives.

Assessing Personal Needs

- Current financial situation

- Future goals & aspirations

- Risk tolerance levels

- Family responsibilities

- Employment benefits

Is insurance better than investment? Discover the pros & cons of each to find out which one suits your needs best. Let’s simplify your choices!

Conclusion

When deciding between insurance & investment, it’s essential to consider your personal needs & goals. If you’re looking for financial security & peace of mind, insurance can be a lifesaver, protecting you from unexpected events. Be that as it may, if you seek to grow your wealth over time, focusing on investment options might be the right choice for you. Ultimately, it isn’t about which is better overall; it’s about what fits your situation best. Combining both can offer a balanced approach, ensuring you’re protected while also planning for a brighter financial future. Choose wisely!